Funding Your Future

Locals come to know the work of Community Foundation Santa Cruz County through many avenues. Whether it’s through a neighbor, through the work of one of our nonprofit partners, or through a professional advisor. But not many can say they had the opportunity to learn about the organization firsthand from one of the founders. Rick Polse is one of those few people.

Rick, a San Francisco native and graduate of UC Berkeley Law, settled in Santa Cruz County in 1975 and began working as an estate planning attorney at a local firm. That firm was run by Ian McPhail, a founder and former president of the Community Foundation. Ian, alongside forward-thinking local leaders like founding trustee Gurden Mooser, and UC Santa Cruz and Cabrillo College founding trustee Hal Hyde, created the Community Foundation in response to the devastating storms of 1982. Within the destruction, they saw a chance to create a force for good for Santa Cruz County that would live forever. They formed a grantmaking public charity dedicated to improving the lives of Santa Cruz County residents and solving community challenges.

Rick had already been having conversations about charitable giving with clients, and he became inspired to use his skills in the service of philanthropy. Rick and Ian established the Planned Giving Center at the Community Foundation, and Rick set out to become, as he puts it, the “local expert in philanthropic giving.”

“It was because of Ian that I found out about the Foundation and understood what it was. I really felt it was a great thing for our community for the long term,” Rick says.

Rick saw the potential of the Charitable Gift Annuity (CGA) as a unique way of establishing a gift that pays the donor income for life, provides a valuable tax deduction, and provides a gift to charity. So, Rick tried it out himself, setting up his own CGA’s to go through the process and better inform his clients.

“I was like the chef who needed to taste the soup,” Ricks says, “I set up a couple of Charitable Gift Annuities so I would really know what it was like.”

Rick was sold on it. He decided to start a CGA program at the Foundation that continues to this day.

“This annuity provides financial support for my wife and me as long as we're alive, and then after we die, it goes to our fund at the Community Foundation, continuing to give back to the community forever.”

What is a CGA?

A Charitable Gift Annuity (CGA) is a contract in which an individual transfers cash, securities or other assets to the Community Foundation in exchange for a fixed annual income for life.

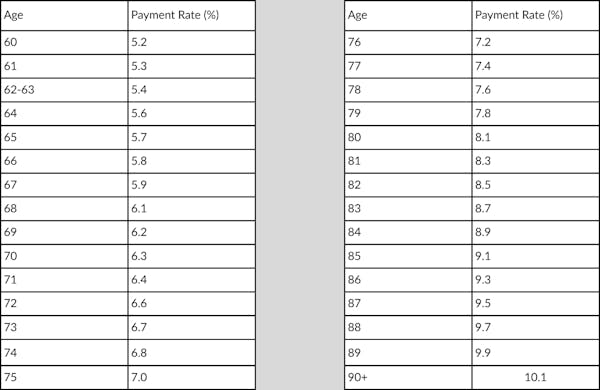

To establish a gift annuity, a donor contributes a minimum gift of $25,000 in cash or securities. The donor then receives an income tax charitable deduction when the gift is established. At the end of their lifetime, the remainder of the gift annuity is distributed to charity. In this way, a CGA can serve as an excellent retirement planning strategy by providing a supplemental, fixed income stream. Individuals must be at least 60 years of age to begin receiving the income payments. The payment rate is based on the age of the beneficiary when payments begin, and these rates are determined yearly by the American Council on Gift Annuities (ACGA).

Let’s say Bess, a supporter of local nonprofits, at age 70 decides to create a CGA by contributing $100,000 from her investment portfolio. In return, she receives a 6.3% payout, which amounts to $6,300 annually for the rest of her life. Part of this income will be tax-free. Additionally, Bess gets a charitable income tax deduction of approximately $38,421 in the year her gift is made.

This arrangement not only enhances her financial future but also enables her to make a lasting impact on the community she loves. Upon her passing, any remaining funds from her annuity will be directed to the Community Foundation as a lasting community resource and also can support our nonprofit partners.

Decades after Rick established the CGA program at the Community Foundation, we are still one of the only local organizations offering charitable gift annuities as a giving option for our community members.

Funding Your Future

Kea Gorden, the Foundation’s Chief Philanthropy Officer, thinks that the CGA is a great giving vehicle for charitably minded people who are considering retirement and/or estate planning.

Kea says, “Donors enjoy the ability to plan for a fixed income stream later in life, the tax benefits of establishing the gift annuity, and the satisfaction of knowing the remainder of the annuity will pass to charity upon its completion. A CGA can be an excellent estate and gift planning tool, and we are glad to provide this option for our local community.”

“This is a no brainer,” Rick says. “For me, it’s such an attractive vehicle for people who have a desire to leave behind a charitable gift and support the work of local organizations.”