A new model for for meeting today's challenges

Impact Investing

“How well does your investment portfolio align with your values?”

- Morgan Simon, author of Real Impact: The New Economics of Social Change

Every investment has an impact. The question is, will the impact be positive or negative, and will it complement or contradict your philanthropic goals?

We started one of the field’s early socially responsible portfolios in 2004 and have launched new options such as our gender equality focused Women’s Inclusion Portfolio. Our capital invests in ventures across the country including those advancing gender and racial equity, supporting affordable housing and renewable energy projects, and building climate and sustainable infrastructure assets and companies. Learn more about our investment strategy.

Funding Solutions

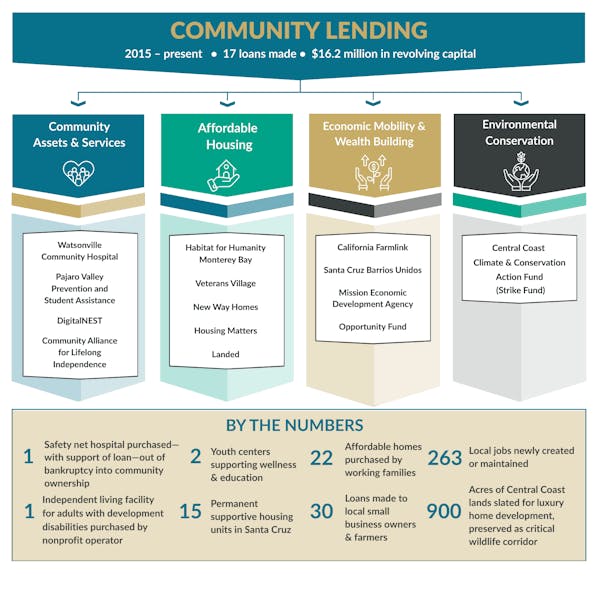

Our local impact investments, in the form of low-interest loans, pursue opportunities that return financial and social gains, right here at home. In 2015, we began making low-interest loans which now total over $16.2 million in capital deployed. Funds are loaned to nonprofits and businesses working towards solutions to social and environmental challenges while spurring economic growth on key issues in our community. Unlike traditional philanthropy, which typically relies on grants, our impact investments are structured as flexible, cost-effective loans that are expected to be paid back, thus recycling the dollars to consistently fund new initiatives into the future.

Putting New Capital to Work

Our revolving capital makes loans to projects that address critical social issues we face in Santa Cruz County, like housing affordability, supporting sustainable agriculture, and economic mobility for our county’s diverse workforce. We have partnered with local organizations, including Habitat for Humanity, Housing Matters, DigitalNEST, Barrios Unidos, and California FarmLink, to create local impact and local returns.

Together with FarmLink, we've helped immigrant and women farmers access the capital they need to expand production, secure long-term leases, and grow their farms. With Housing Matters, we helped finance their Casa Azul project, providing permanent supportive housing for people in Santa Cruz County who have been chronically homeless.

New Tools for Conservation and Climate Resilience

Quick and inexpensive capital from another revolving loan fund will also help conservation, restoration, and nature-based climate solutions reach the finish line through our Central Coast Climate and Conservation Action Fund, known as the “Strike Fund.”

The Strike Fund is a revolving loan fund for the whole Central Coast region, empowering partners—including the Trust for Public Land, the Land Trust of Santa Cruz County, and the Amah Mutsun Land Trust—to quickly purchase prioritized lands before they are sold and developed.

An Opportunity for Donors

As our loans are repaid, the funds are reissued to new projects, and donors’ dollars are used time and again, multiplying the impact of each gift. With a donation to our Community Investment Revolving Loan Fund, you can make a gift that invests capital for local social good.

An Opportunity for Nonprofit Organizations

Would a low-interest loan help make your social impact project happen? Find out more about how to apply by contacting Courtney Reed, our Investment & Reporting Accountant.