Your Community Foundation

Our Mission

We bring together people, ideas, and resources to inspire philanthropy and accomplish great things.

Our Vision

To make Santa Cruz County thrive for all who call it home, now and in the future.

Our Values Drive Our Actions

Foundation Overview

$251m

grants awarded since 1982

$30m

in 2023 grants, loans & scholarships

894

nonprofits served

8.3%

average 10-yr rate of return

$10m

revolving loan capital

$223m

in assets

Why We Exist

A Lasting Solution

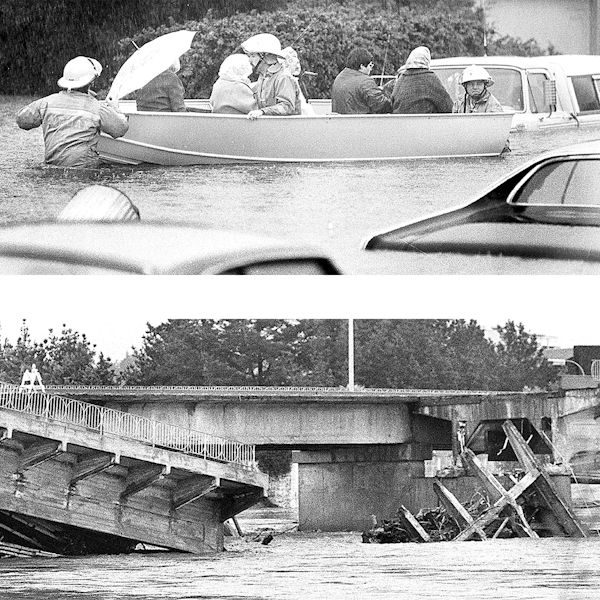

In 1982, a storm dropped 25 inches of rain on Santa Cruz County over three days, causing devastating flooding and mudslides. Generous people looking to help were searching for a central organization to send donations to—one that would support the long-term recovery efforts. But, such an organization didn’t yet exist. Community Foundation Santa Cruz County was formed to meet that need.

Our Team

Our Dedicated Staff and Board Leadership

Learn about the people behind Community Foundation Santa Cruz County who help put your generosity to work to improve Santa Cruz County.

In Depth

Get into the details about us here:

A Vital Resource

Regional Water Management Foundation

The Regional Water Management Foundation was established by Community Foundation Santa Cruz County, in cooperation with local agencies, to support planning and obtain funding for water resource projects in Santa Cruz County. Since 2008, $14.8 million in state grants have been awarded through the Foundation.

Learn about the Regional Water Management Foundation’s work and meet the team promoting local coordination and collaboration on water resources management.

Connect With Your Community Foundation

Let’s talk about how you can help improve lives in Santa Cruz County.